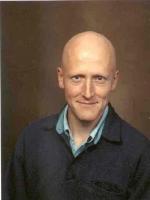

Professor of Statistical Science

Research Interests: Financial mathematics, probability theory, stochastic analysis, statistics, mathematical economics

Publications

Volatility estimation with price quanta

– Mathematical Finance

(2002)

8,

277

(doi: 10.1111/1467-9965.00056)

Arbitrage with fractional Brownian motion

– Mathematical Finance

(2002)

7,

95

(doi: 10.1111/1467-9965.00025)

Complete Models with Stochastic Volatility

– Mathematical Finance

(2002)

8,

27

(doi: 10.1111/1467-9965.00043)

The potential approach to the term structure of interest rates and foreign exchange rates

– Mathematical Finance

(2002)

7,

157

(doi: 10.1111/1467-9965.00029)

Markov chains and the potential approach to modelling interest rates and exchange rates

– MATHEMATICAL FINANCE - BACHELIER CONGRESS 2000

(2002)

375

A simple model of liquidity effects

(2002)

161

Utility maximisation with a time lag in trading

(2002)

74,

249

Robust Hedging of Barrier Options

– Mathematical Finance

(2001)

11,

285

(doi: 10.1111/1467-9965.00116)

The relaxed investor and parameter uncertainty

– Finance and Stochastics

(2001)

5,

131

(doi: 10.1007/pl00013532)

The maximum maximum of a martingale constrained by an intermediate law

– Probability Theory and Related Fields

(2001)

119,

558

(doi: 10.1007/pl00008771)

- <

- 7 of 13